The GST Portal is the official government platform for managing all activities related to Goods and Services Tax in India. Whether you need to register your business, log in to file returns, verify a GST number, calculate tax, or check your application status, everything is available in one place at gst.gov.in. Using the GST Login feature, taxpayers can securely access their dashboard and manage all GST-related activities online.

This comprehensive guide explains everything you need to know about the GST e portal — how to log in, register, verify GST numbers, and use tools like the GST calculator. It’s written to help business owners and taxpayers understand the system in a simple and natural way.

What is the GST Login Portal

The GST Portal is the official website of the Goods and Services Tax Network (GSTN). It allows businesses and individuals to handle all GST-related tasks online. It’s designed to simplify the process of registration, return filing, payment, and tax calculation, reducing paperwork and manual errors.

Through the GST e portal, taxpayers can register for GST, file returns, make payments, apply for refunds, and verify GST numbers. It also serves as a source for the latest notifications and circulars issued by the government.

Simply put, it is a single platform for all GST services.

GST Login – How to Access the Portal

The GST Login process helps registered users manage their GST account easily. After logging in, you can file returns, make tax payments, and check notices directly from the official portal. The login process is simple and requires only your username and password to access the dashboard.

Steps to log in to the gst gov in portal:

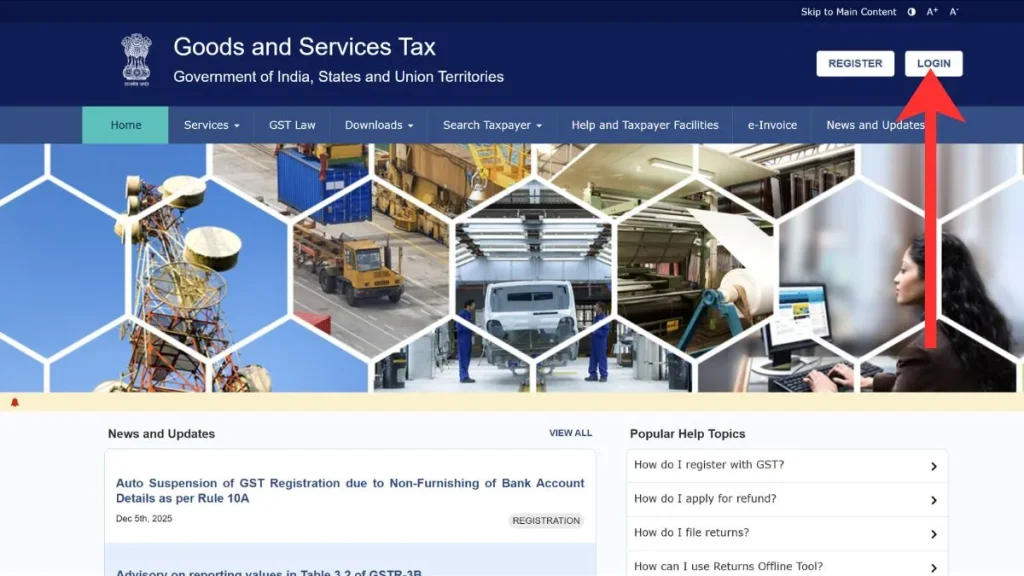

- Visit www.gst.gov.in.

- Click the Login button in the top right corner.

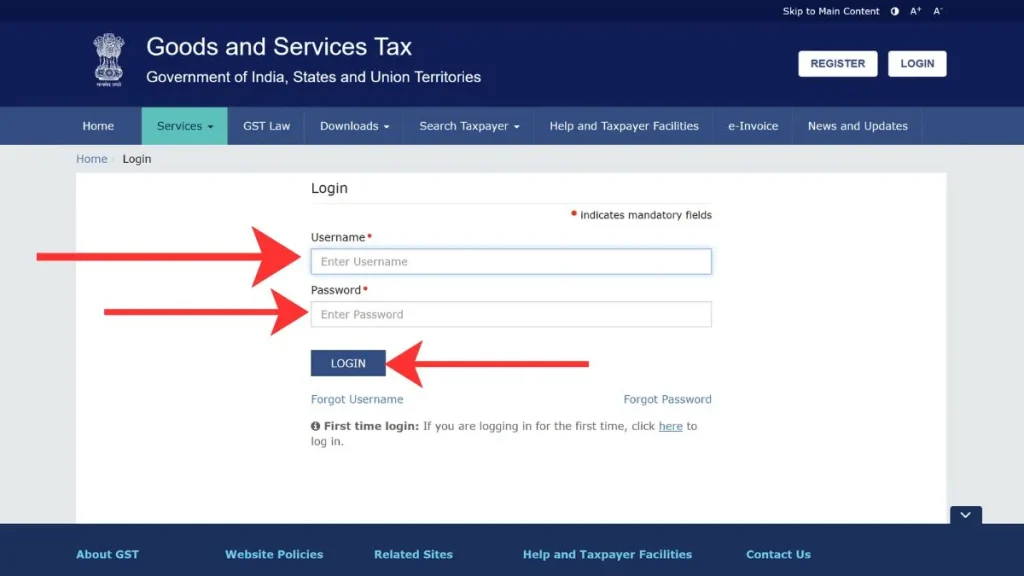

- Enter your username and password.

- Click Login to enter your account.

Once logged in, you’ll be able to access your profile, file returns, track payments, and manage notices.

If you’ve forgotten your credentials, click on “Forgot Password,” enter your username, and reset your password using the OTP sent to your registered mobile number or email address.

How to Register for GST Online

Businesses with an annual turnover exceeding the prescribed limit must register for GST. The entire process is online and takes only a few days to complete.

Steps for GST registration:

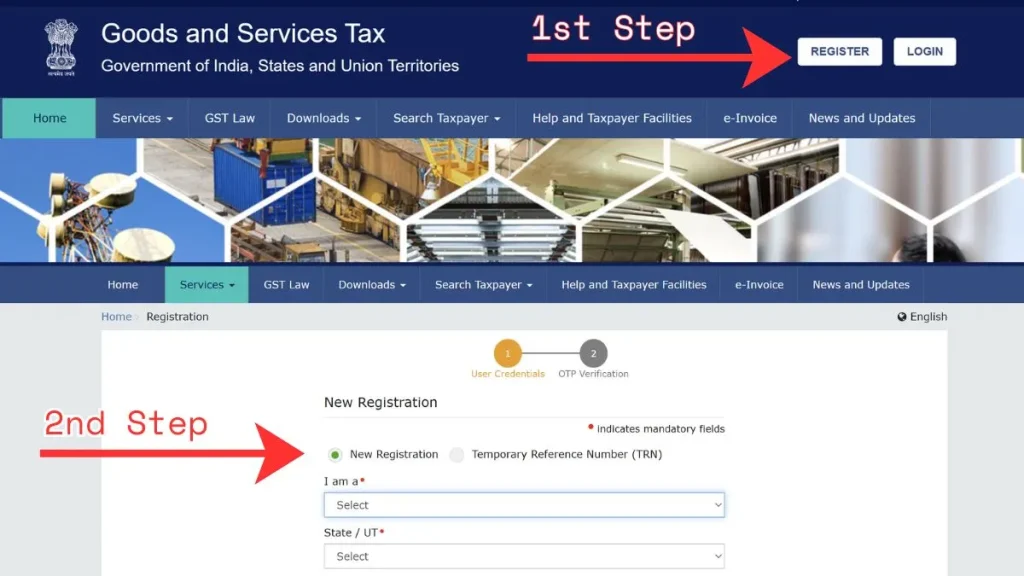

- Go to the GST portal and click Services → Registration → New Registration.

- Select the New Registration option if you are registering for GST for the first time.

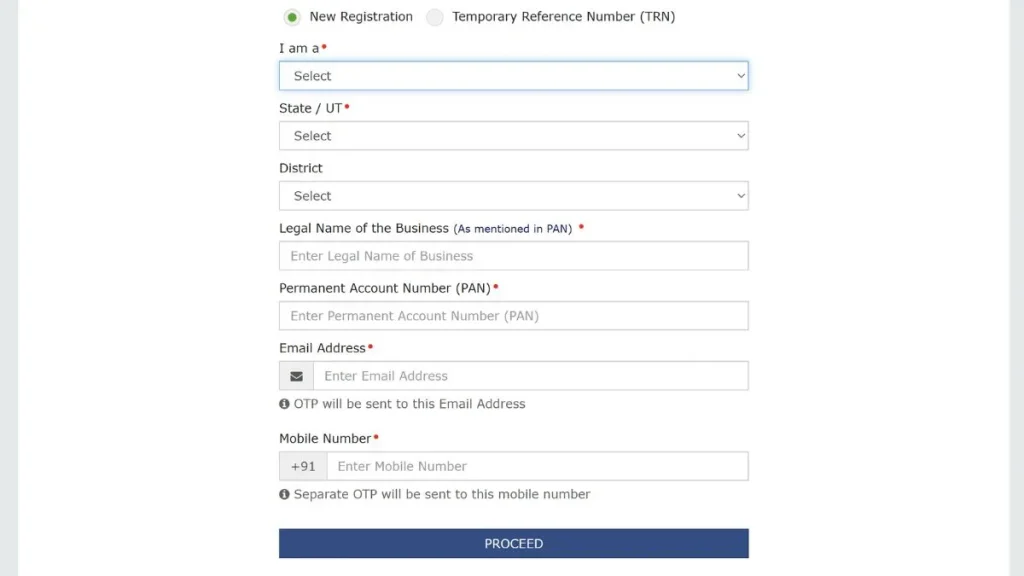

- In the “I am a” field, choose the appropriate type of applicant from the dropdown.

- Select your State / UT where the business is located.

- Choose the District from the dropdown list.

- Enter the Legal Name of the Business exactly as mentioned on the PAN card.

- Enter the Permanent Account Number (PAN) of the business.

- Enter your Email Address.

An OTP will be sent to this email address. - Enter your Mobile Number.

A separate OTP will be sent to this mobile number. - Click on the Proceed button and verify the OTPs received on your email and mobile number.

After submission, you will receive an Application Reference Number (ARN). You can use this ARN to check the status of your GST registration on the portal.

The gst common portal also allows businesses to complete their fast-track GST registration online through simplified digital verification, reducing the need for physical document submission.

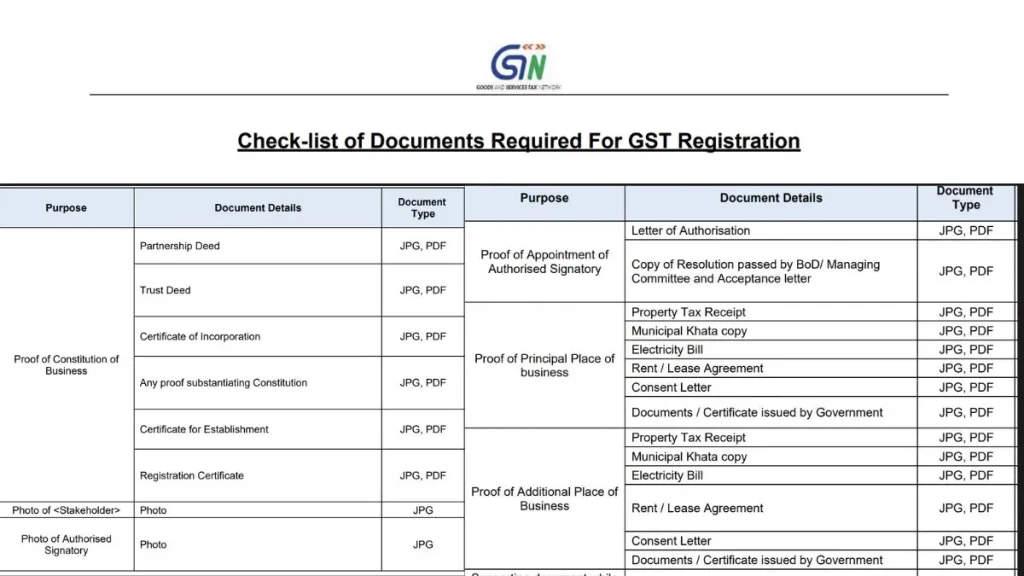

Documents Required for GST Registration

To complete GST registration, you need to upload the following documents based on your business details:

- Keep PAN card and Aadhaar card ready (owner/partners)

- Arrange business proof (Partnership Deed / Incorporation Certificate / Registration Certificate)

- Keep one address proof (Electricity Bill or Rent/Lease Agreement)

- Provide Authorised Signatory proof (Letter of Authorisation, if applicable)

- Upload photograph of owner or authorised signatory

- All documents should be in JPG or PDF format

- Submit details on the GST portal

- Note down the ARN number after submission

Tip: For rented premises, Rent Agreement + Electricity Bill is the easiest and most accepted option.

GST Verification – How to Verify GST Numbers Online

Before engaging in business with a supplier or client, it’s wise to verify their GST number. Verification confirms the authenticity of a GSTIN and helps prevent tax fraud.

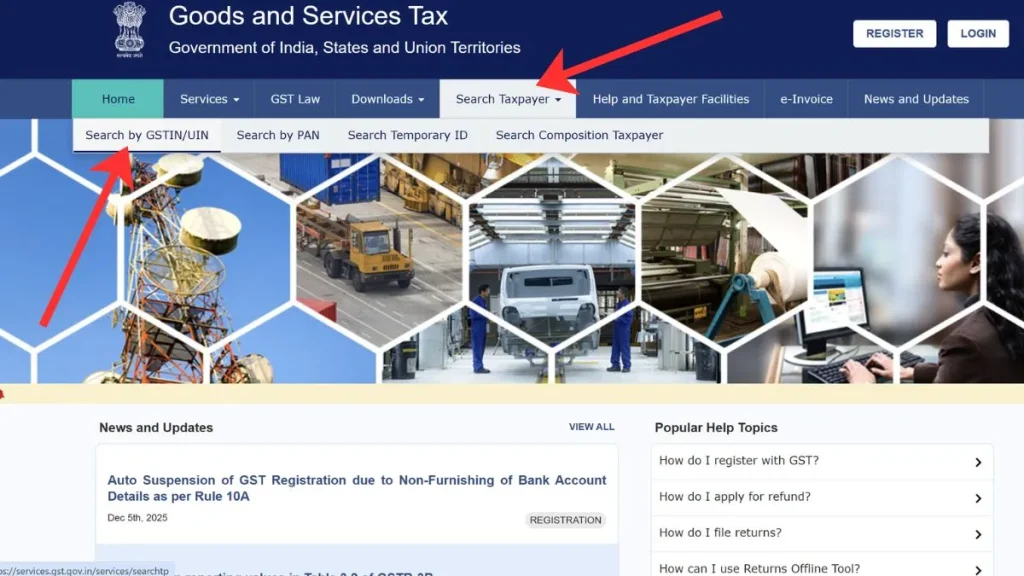

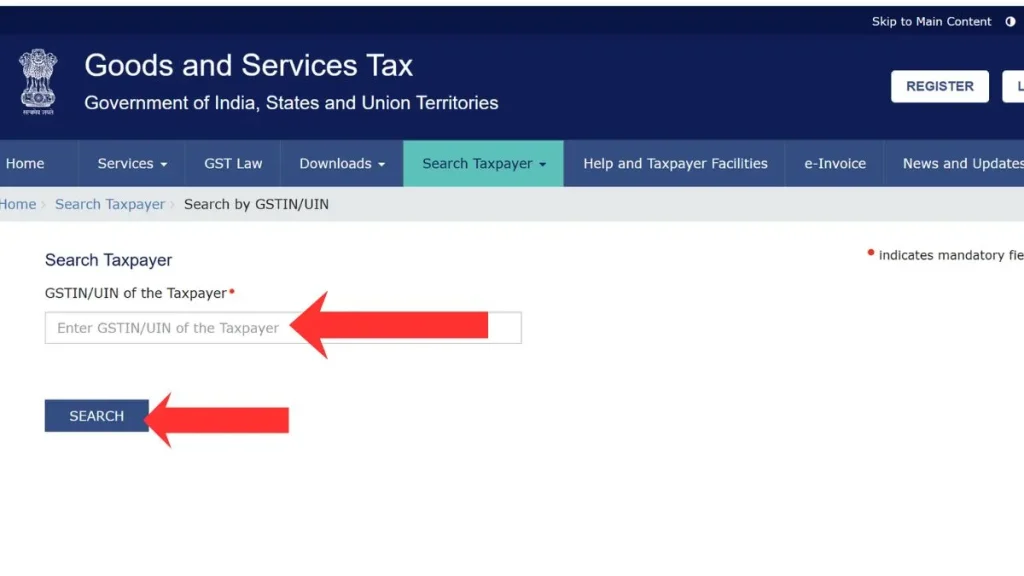

To verify a GST number:

- Visit www.gst.gov.in.

- Click on Search Taxpayer → Search by GSTIN/UIN.

- Enter the 15-digit GSTIN.

- Click Search.

The page will display information like the legal name, trade name, type of business, registration date, and current status (active or cancelled).

GST verification helps ensure transparency and trust in business transactions.

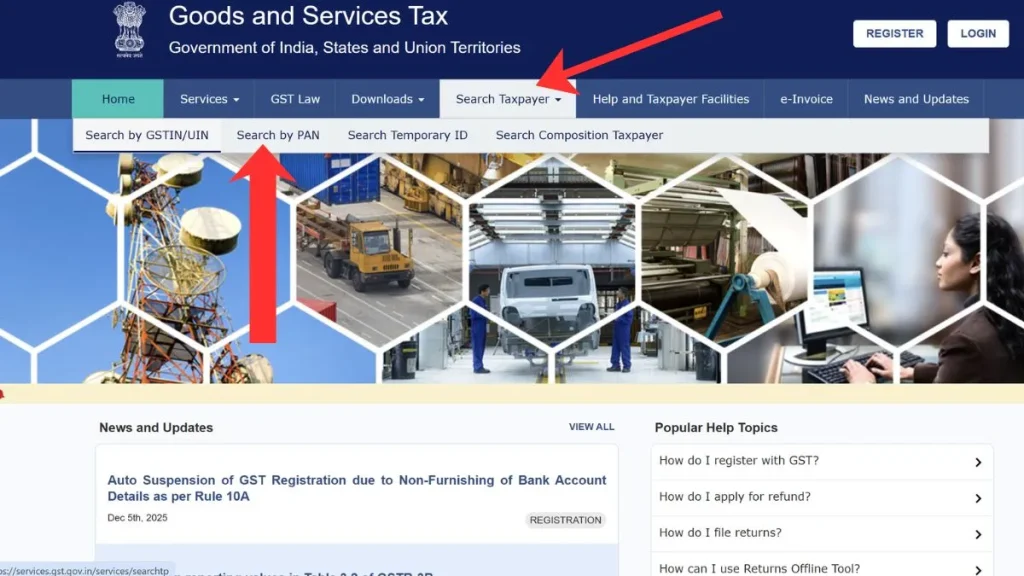

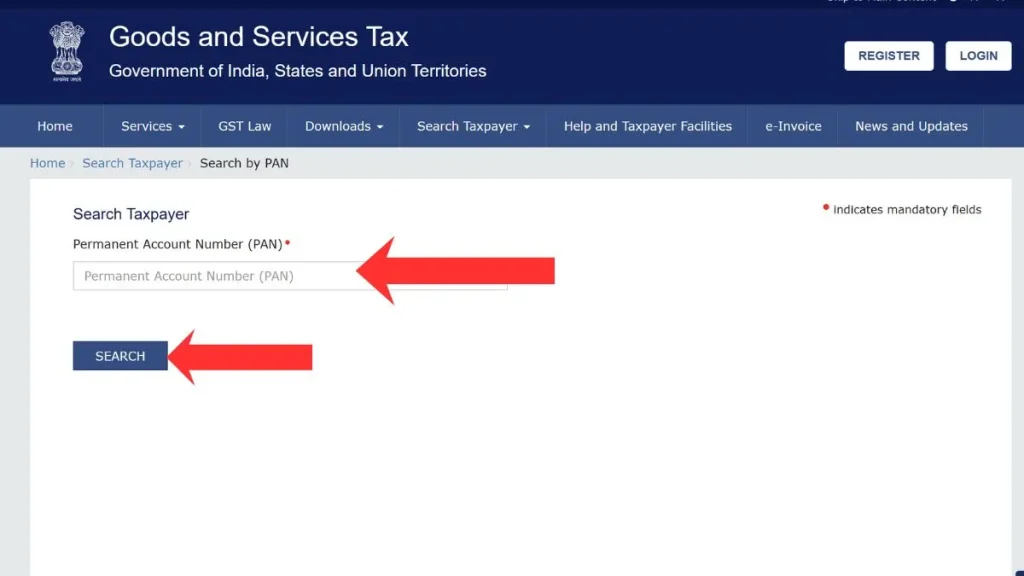

GST Number Check by PAN

If you want to find a GST number using a PAN card, you can do it easily through the gst verification portal.

Steps to search GST number by PAN:

- Visit the GST portal.

- Go to Search Taxpayer → Search by PAN.

- Enter your PAN number.

- Click Search to see all GST numbers linked to that PAN.

GST Calculator – Simple Way to Calculate GST

The GST calculator helps taxpayers quickly determine the GST amount payable or receivable on goods and services. It can calculate both inclusive and exclusive GST values.

The formula to calculate GST is:

- GST Amount = (Original Cost × GST Rate) ÷ 100

- Total Amount (including GST) = Original Cost + GST Amount

For example, if an item costs ₹10,000 and the GST rate is 18%, then GST = ₹1,800 and total cost = ₹11,800.

You can use the online calculator on the GST common portal or third-party sites to make the process faster and error-free.

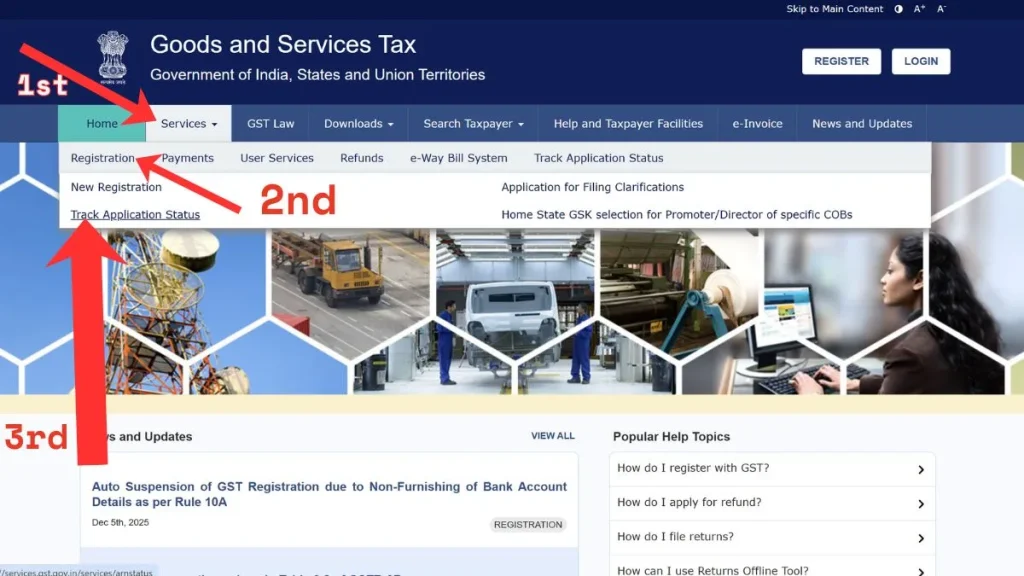

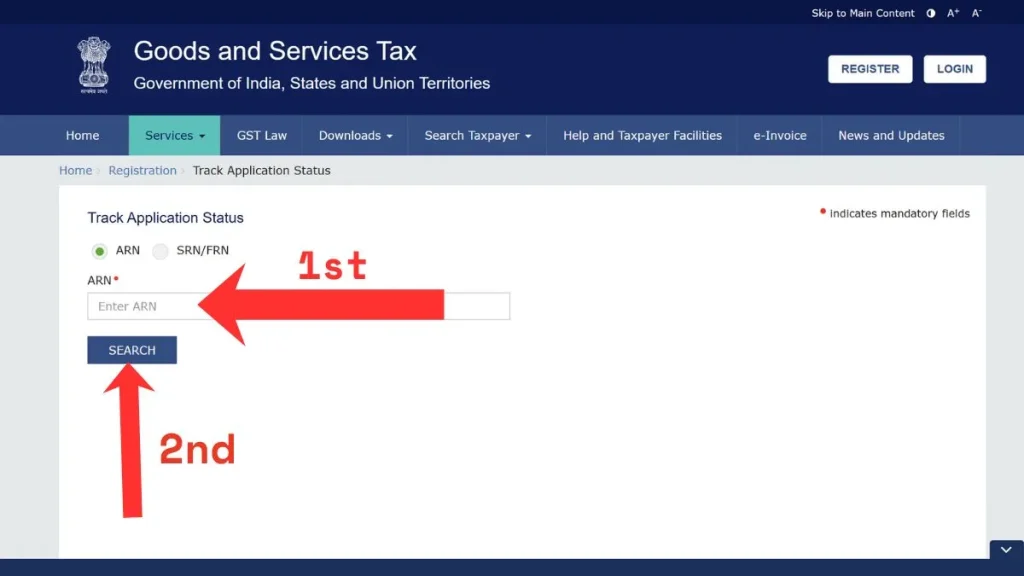

Checking GST Application Status

After submitting your registration form, you can easily track its progress on the gst gov in portal.

Steps to check GST registration status:

- Visit the official site.

- Go to Services → Registration → Track Application Status.

- Enter your ARN (Application Reference Number).

- Click Search.

The system will show whether your application is pending, approved, rejected, or needs clarification. If clarification is requested, you can log in to your account and upload the required documents.

Services Available on the GST Portal

The gst common portal offers a wide range of services for taxpayers:

- Registration (new, amendment, or cancellation)

- Return filing for GSTR-1, GSTR-3B, GSTR-9, etc.

- Payment and challan generation

- Refund applications

- Access to electronic cash, credit, and liability ledgers

- E-invoicing services through the gst e invoice portal (for eligible taxpayers)

- User services like profile management and helpdesk support

It provides all the tools needed to manage GST compliance from one dashboard.

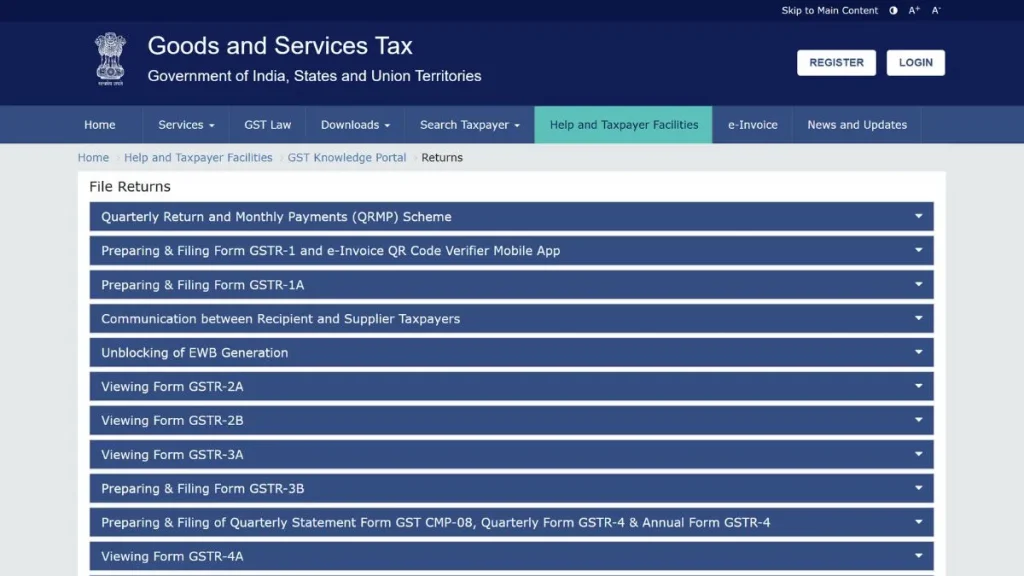

How to File GST Returns Online

Filing returns is one of the most important tasks for GST-registered taxpayers.

Steps to file GST returns:

- Log in to your account on the GST portal.

- Navigate to Services → Returns → Returns Dashboard.

- Select the return filing period.

- Choose the appropriate return type (such as GSTR-1 or GSTR-3B).

- Enter details of sales, purchases, tax liability, and input tax credit.

- Review your entries carefully.

- Pay any outstanding amount.

- Submit and file using DSC or EVC.

This ensures compliance with GST laws and avoids penalties.

Types of GST Returns

Different taxpayers have to file different returns depending on their business type and turnover:

| Return Type | Purpose | Frequency |

| GSTR-1 | Outward supplies or sales | Monthly/Quarterly |

| GSTR-3B | Summary return | Monthly |

| GSTR-9 | Annual return | Annually |

| GSTR-4 | For composition dealers | Annually |

| GSTR-7 | TDS returns | Monthly |

| GSTR-8 | TCS by e-commerce operators | Monthly |

Timely filing of these returns helps maintain a good compliance record.

GST Login Problems and Their Solutions

Some users face issues during GST Login on the GST portal. Here are common problems and their fixes:

- Invalid username or password: Use the “Forgot Password” option to reset.

- DSC not working: Install or update the DSC utility tool from the portal.

- Captcha not showing: Clear your browser cache or try a different browser.

- Error in application: Recheck all mandatory fields and upload documents correctly.

Benefits of Using the GST Portal

Using the GST e portal offers several benefits to businesses and taxpayers:

- Complete online accessibility without paperwork

- Real-time status updates and verification

- Automatic calculation of taxes and credits

- Transparent compliance process

- Secure and government-managed infrastructure

It saves time and makes tax filing more efficient.

GST Search Function – Verify Businesses Instantly

The GST search feature allows users to check business details quickly using GSTIN, PAN, or legal name.

It is useful for:

- Checking supplier authenticity

- Preventing fake invoicing

- Ensuring eligibility for Input Tax Credit

- Building trust in B2B transactions

Always use the official portal for any GST number check to avoid fraudulent information.

How to Make GST Payments

Making payments on the GST Payment Portal is simple.

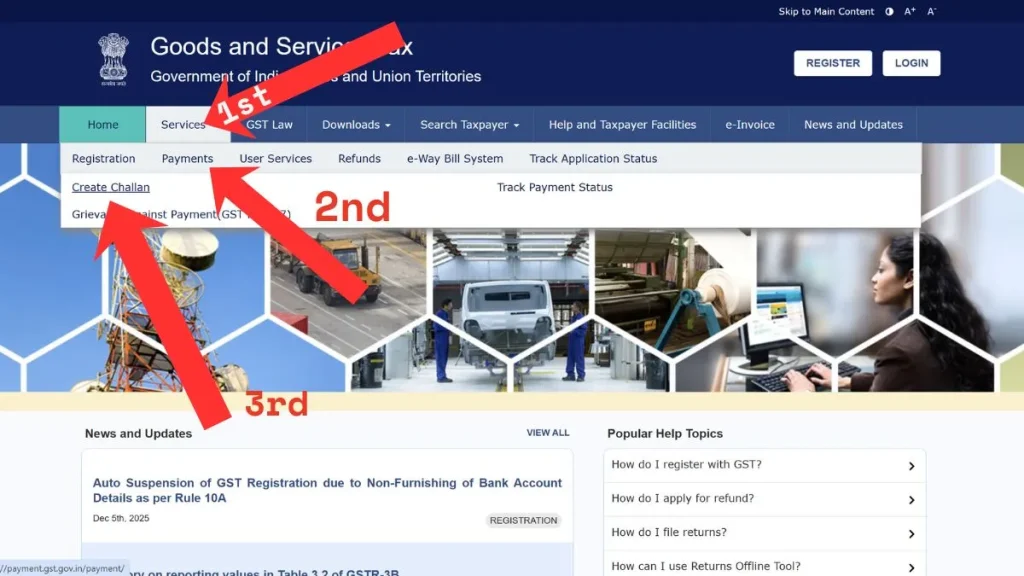

Steps to pay GST online:

- Log in to your account.

- Go to Services → Payments → Create Challan.

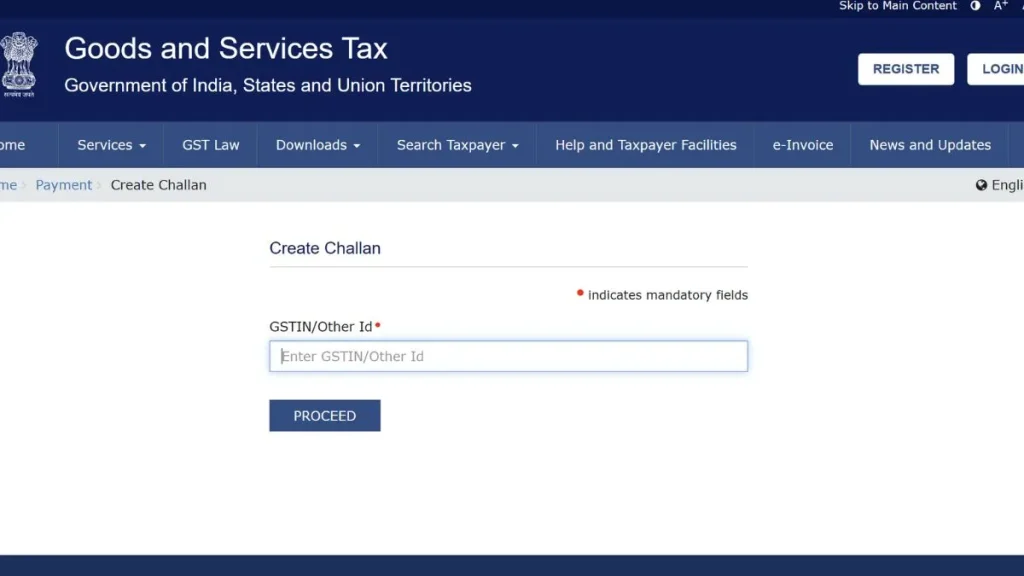

- Enter your GSTIN / Other ID in the given field.

- Ensure the details entered are correct, as this field is mandatory.

- Click on the Proceed button to move to the next step.

- After proceeding, you will be able to enter tax amounts and select the payment mode.

You can track payment history and download receipts from your dashboard.

GST Portal for Composition Dealers

Small businesses with a turnover of up to ₹1.5 crore can opt for the Composition Scheme. It offers lower tax rates and simpler compliance.

Composition dealers can use the GST portal to file annual returns (GSTR-4) and make payments online. This system reduces the burden of frequent filings and helps small businesses stay compliant.

Using GST Portal on Mobile Devices

The GST portal is mobile-friendly, allowing users to access key features anytime. You can log in through a smartphone to file returns, verify GST numbers, use the GST calculator, and track your registration status.

The official GST app and other third-party apps also offer similar functionality for convenience.

Importance of GST Verification

Verifying GST numbers before making transactions helps prevent fake invoicing and ensures your input tax credit remains valid. It builds trust and transparency between businesses. Always verify GST numbers using the official GST verification tool available on the government portal.

GST Helpdesk and Support

If you face issues with registration, login, or any GST-related process, you can contact the GST Helpdesk.

- Helpline: 1800-103-4786

- Email: helpdesk@gst.gov.in

You can also raise online complaints or support tickets from your GST account under the Help section.

Security Tips for Using the GST Portal

For safe use of the GST portal:

- Do not share your password or OTP.

- Always log out after completing your work.

- Use the official website only (gst.gov.in).

- Check for the lock icon in the browser address bar for site security.

- Keep your contact information updated.

Frequently Asked Questions

What is the official GST login website?

The official website is www.gst.gov.in.

Can I check GST numbers without logging in?

Yes, the GST number search tool is public and can be used without logging in.

How can I verify a GSTIN?

Use the Search Taxpayer → Search by GSTIN option on the portal.

Is GST registration mandatory for all businesses?

It is mandatory for businesses with annual turnover above ₹40 lakh (₹20 lakh for services).

How can I calculate GST quickly?

Use the online GST calculator on the GST portal for accurate results.

How do I complete GST Login online?

To complete GST Login, visit www.gst.gov.in, click on Login, enter your username, password, captcha, and access your dashboard securely.